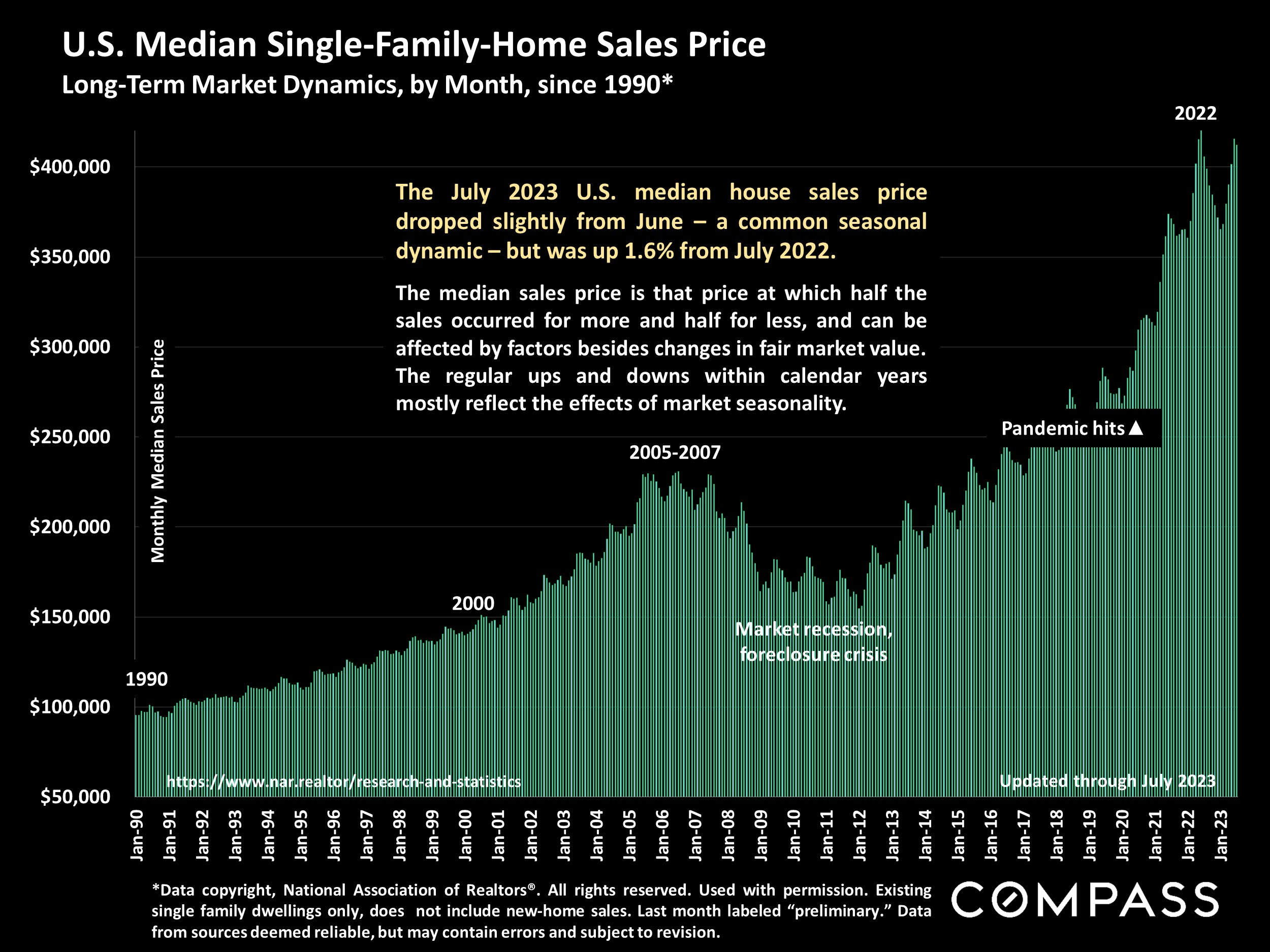

Long-term, national median home sales prices since 1990: The July 2023;

Median price was slightly down from June, but up from July 2022.

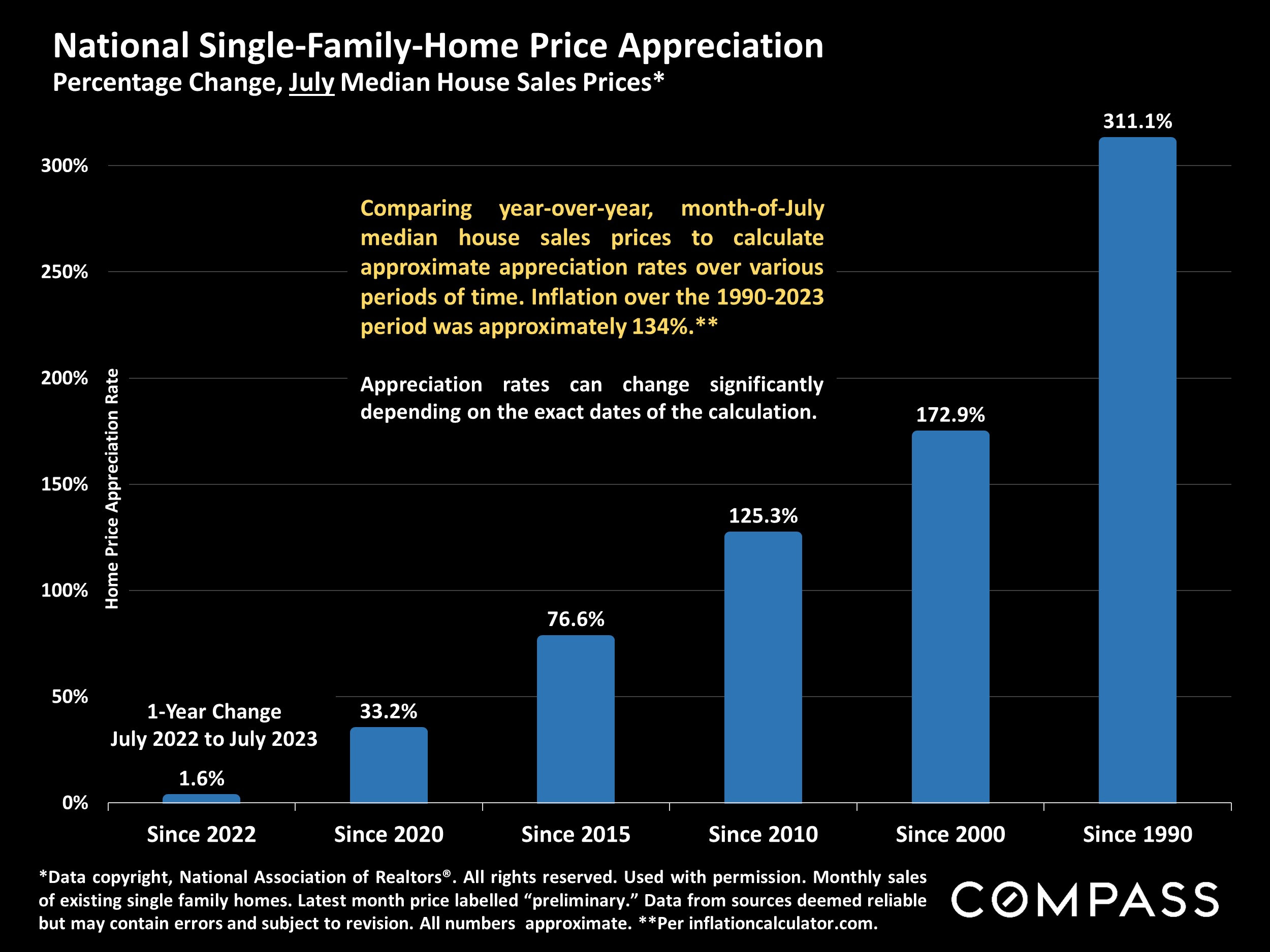

U.S. median house sales price appreciation over varying periods since 1990.

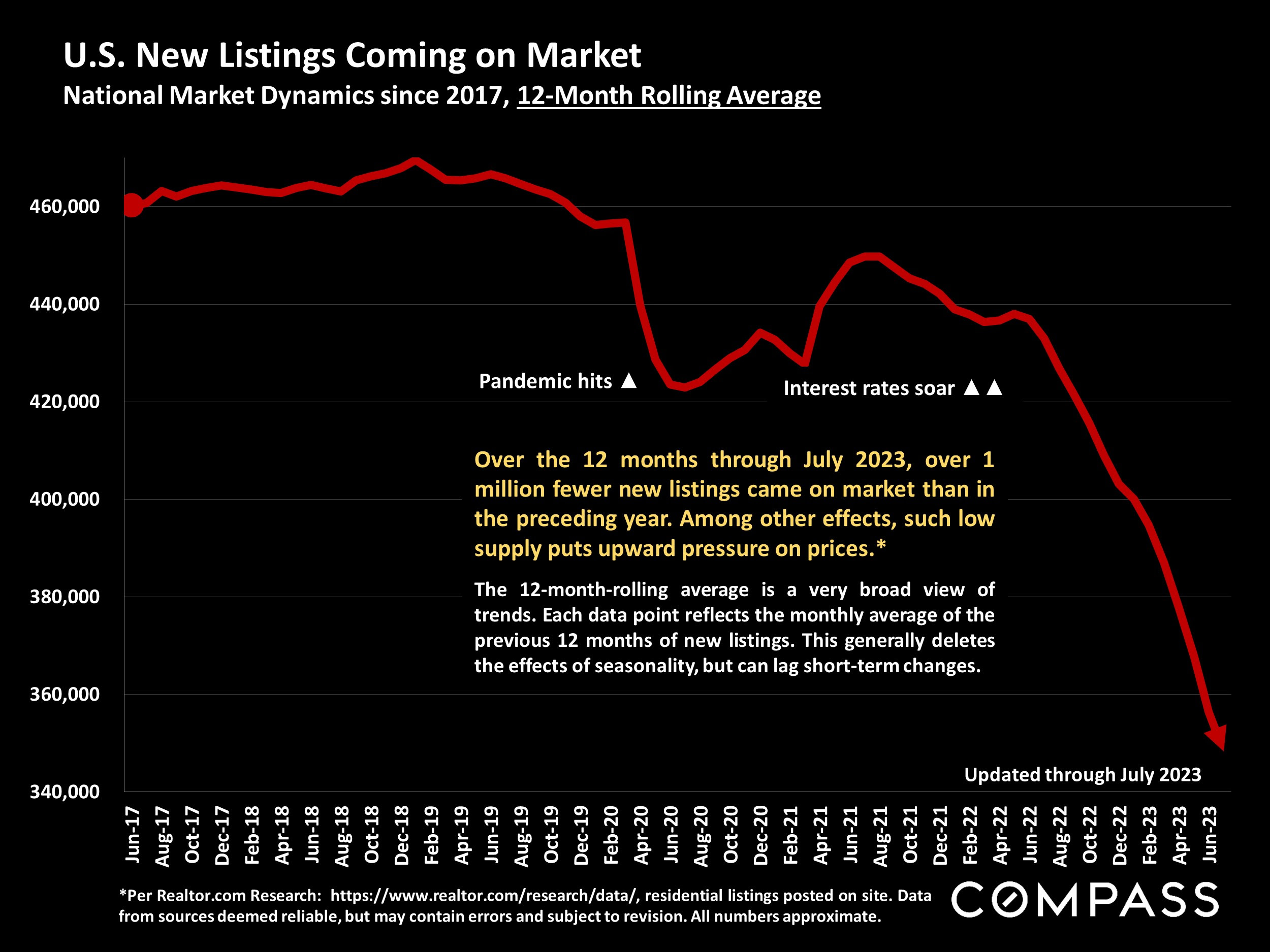

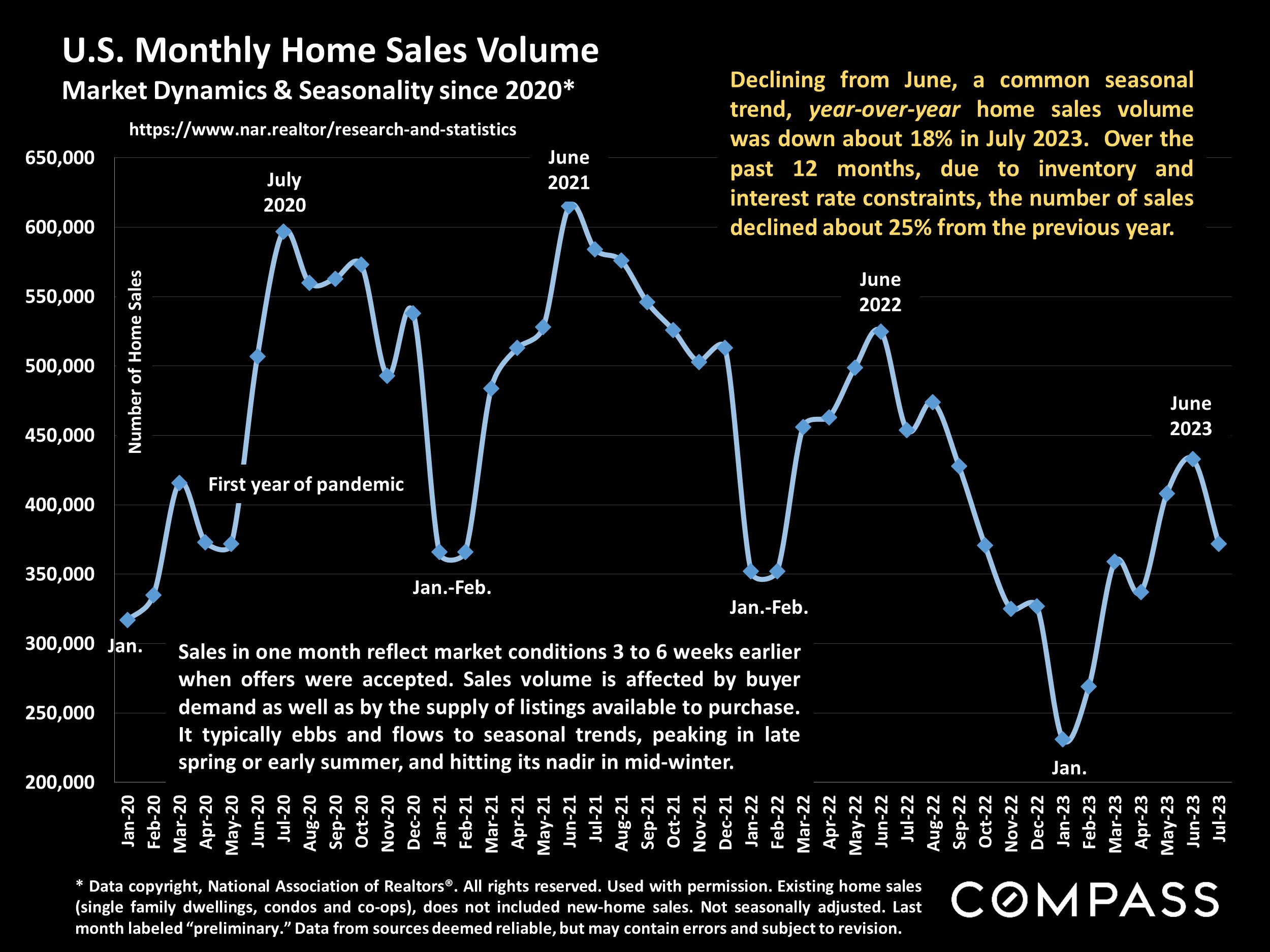

The historic decline in the number of new listings over the past 12 months has depressed sales volume, and, in 2023, helped to push home prices higher.

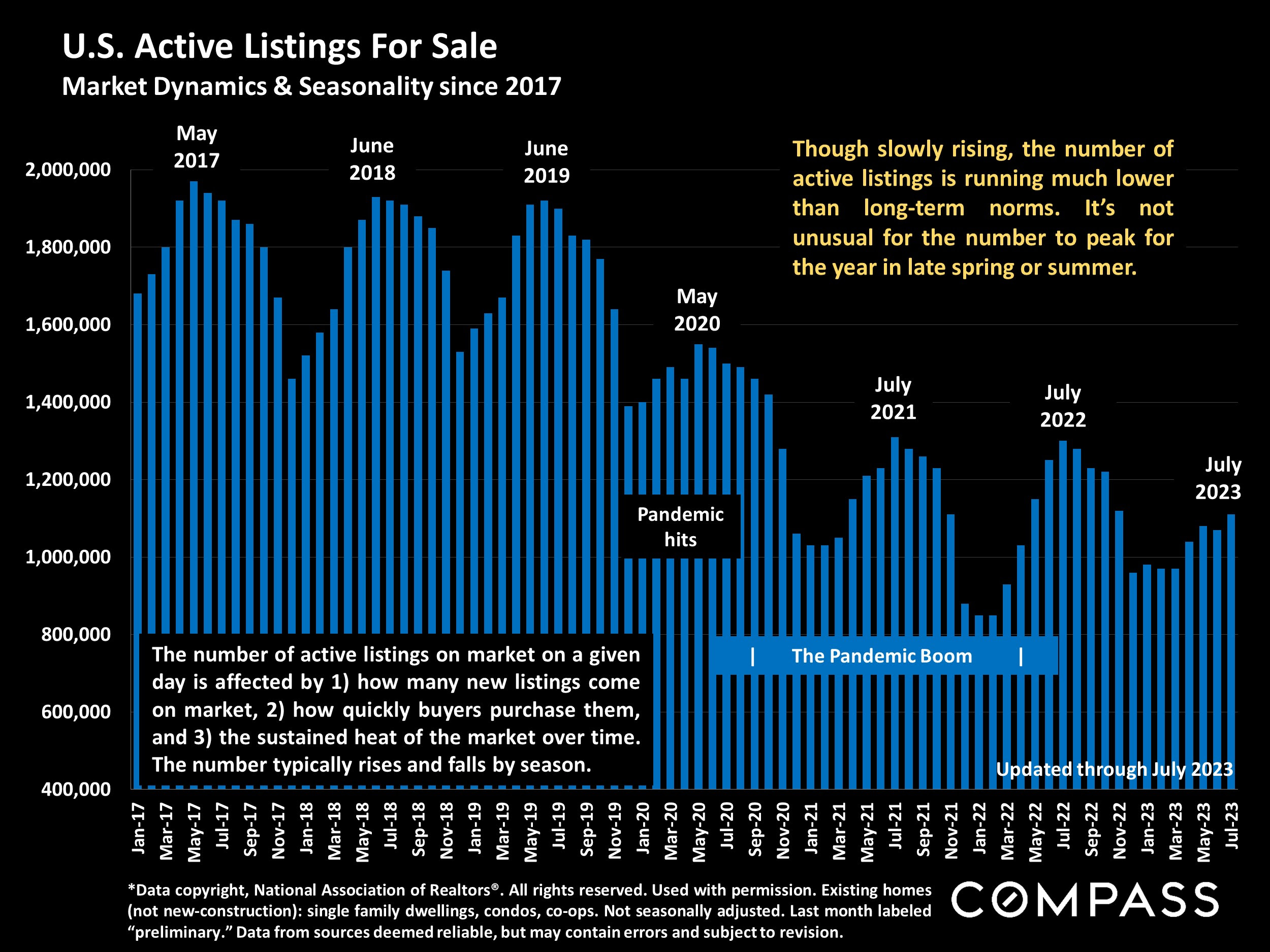

The total number of homes for sale remains very low, clearly inadequate to demand. It typically ebbs and flows according to seasonal trends.

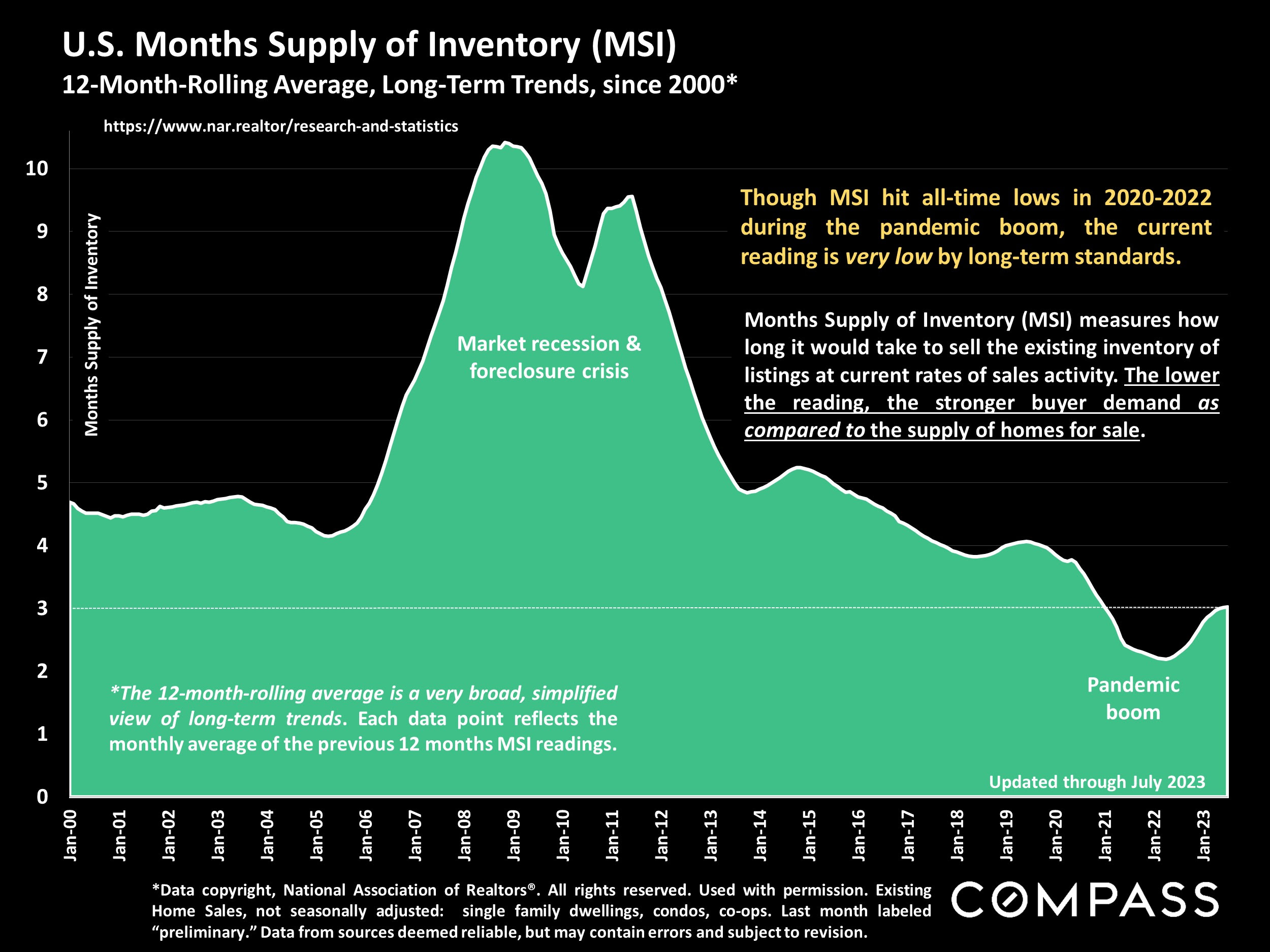

Months-supply-of-inventory compares the supply of listings to the strength of demand: Lower readings signify more competitive, more heated markets.

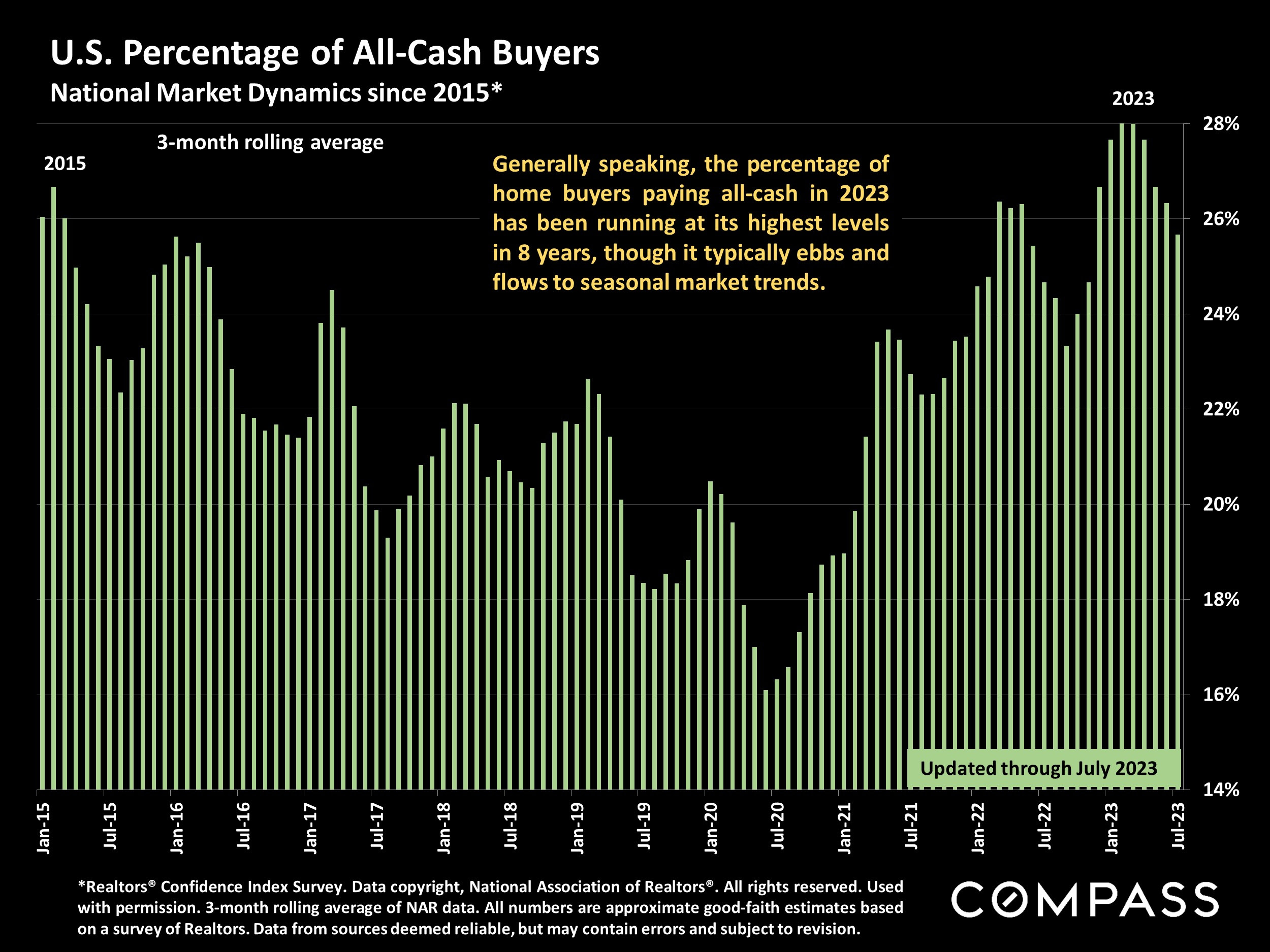

For buyers paying all-cash, interest rates are of less (or no) concern. As a percentage of buyers, they have played a larger role in the 2023 market.

The huge decline in new listings coming on market amid higher interest rates has caused the number of monthly home sales to drop substantially.

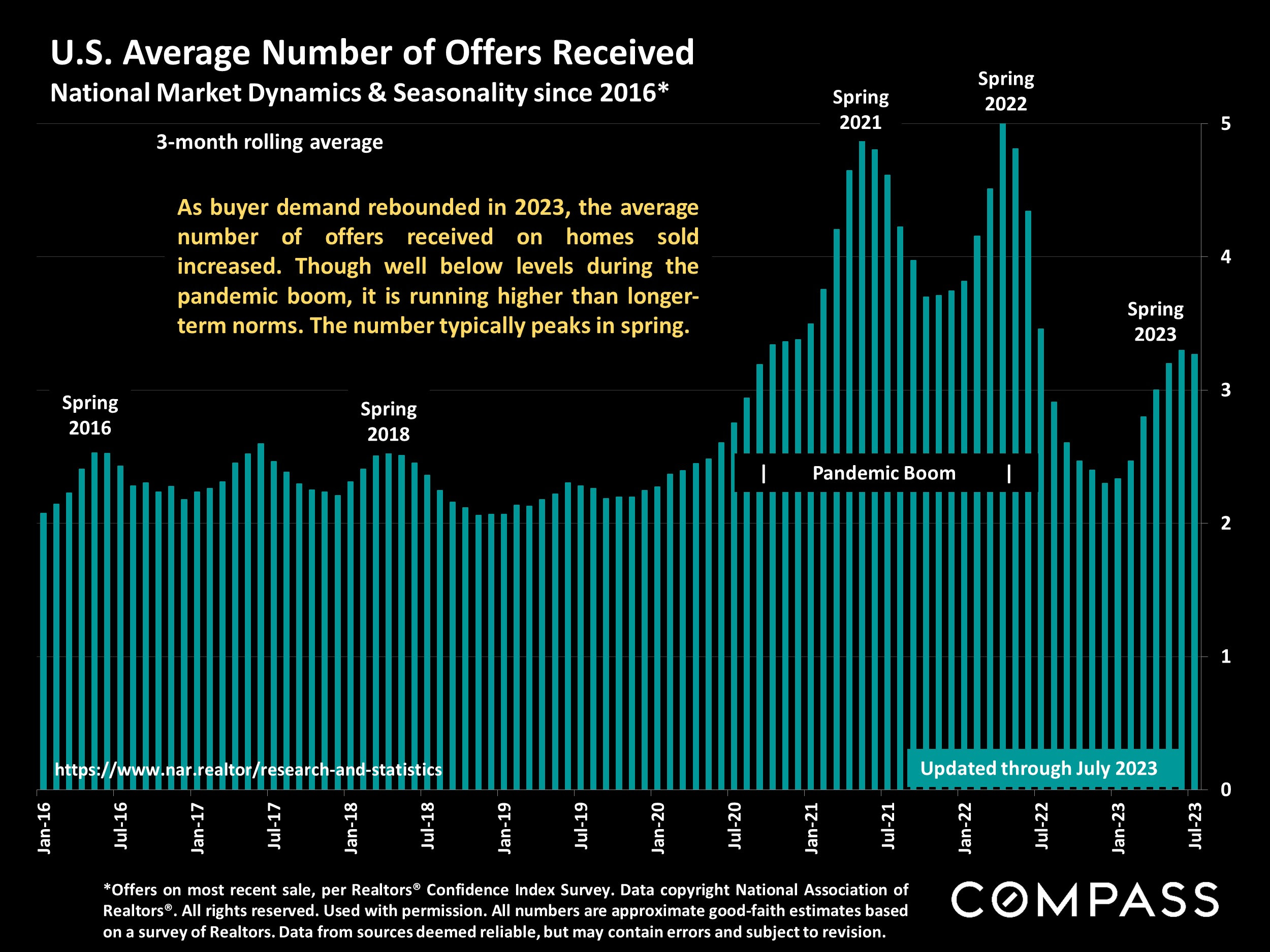

Increasing demand vs. an inadequate supply of homes for sale = more competition – and more offers – for appealing new listings.

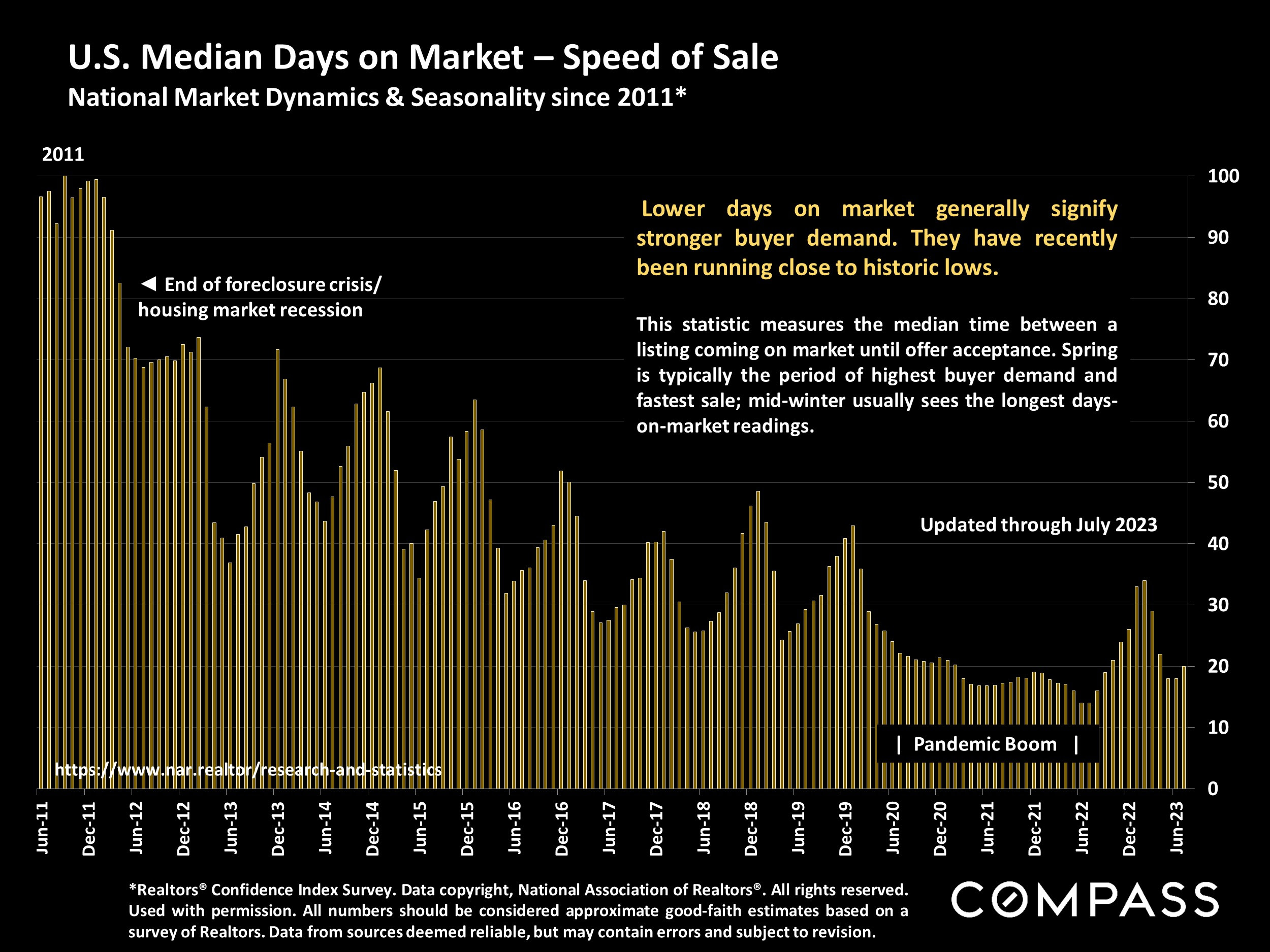

Days on market – the speed at which the homes that sell go into contract – are another major indicator of the heat of demand, and remain very low.

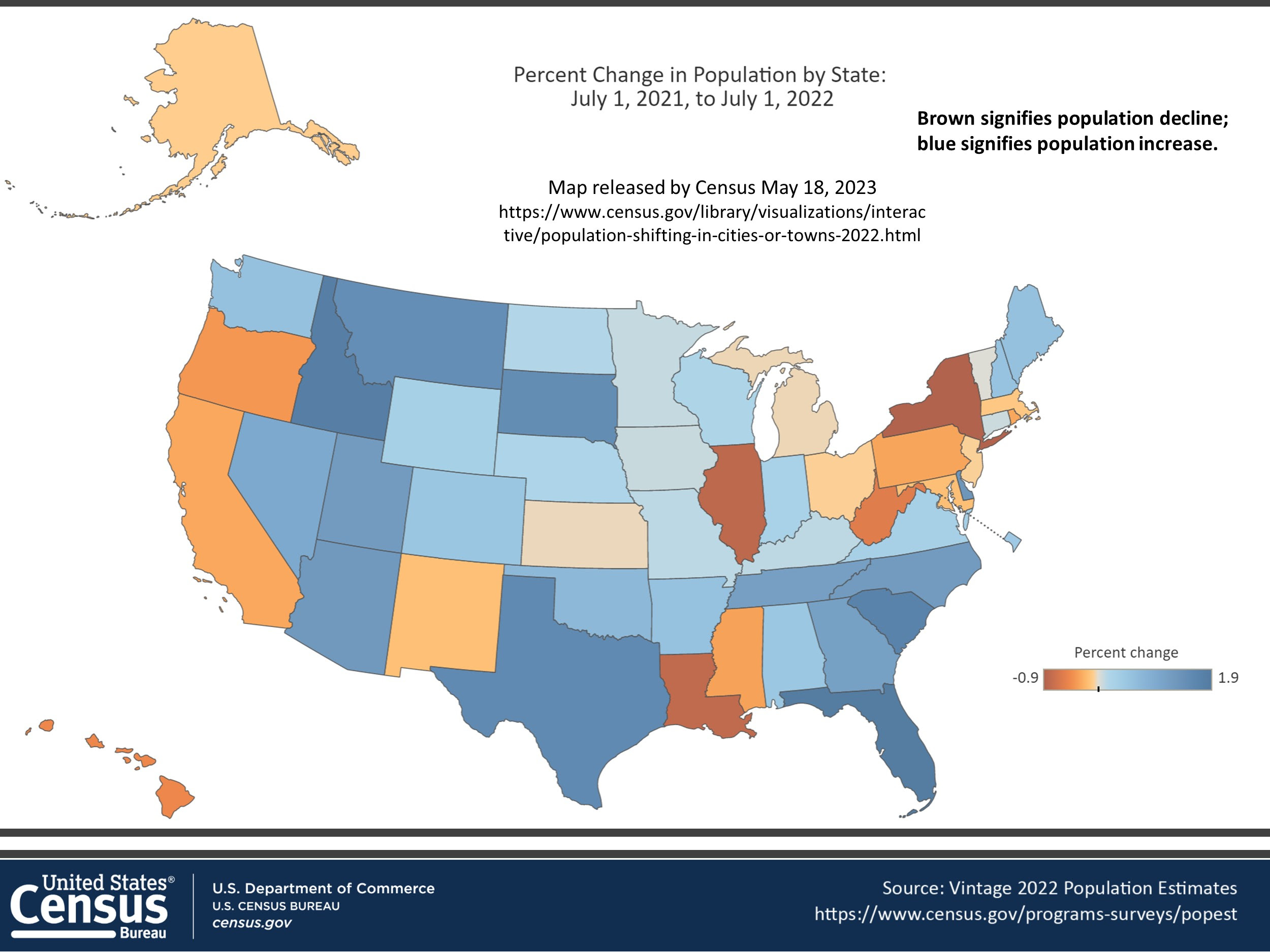

Population migration has been a major market dynamic in recent years. This U.S. Census map illustrates 2021-2022 % state population changes.

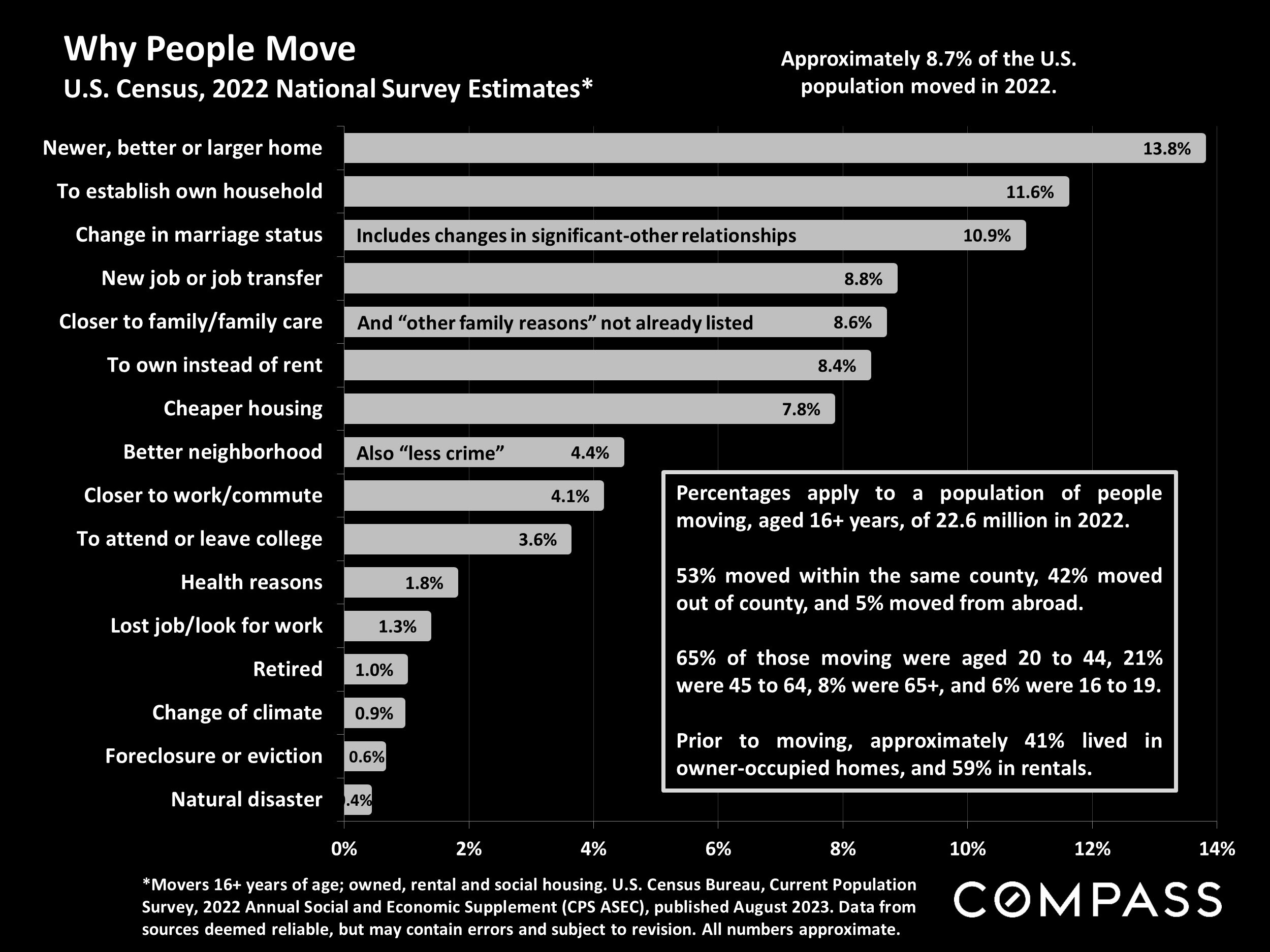

A new U.S. Census survey on why people moved in 2022.

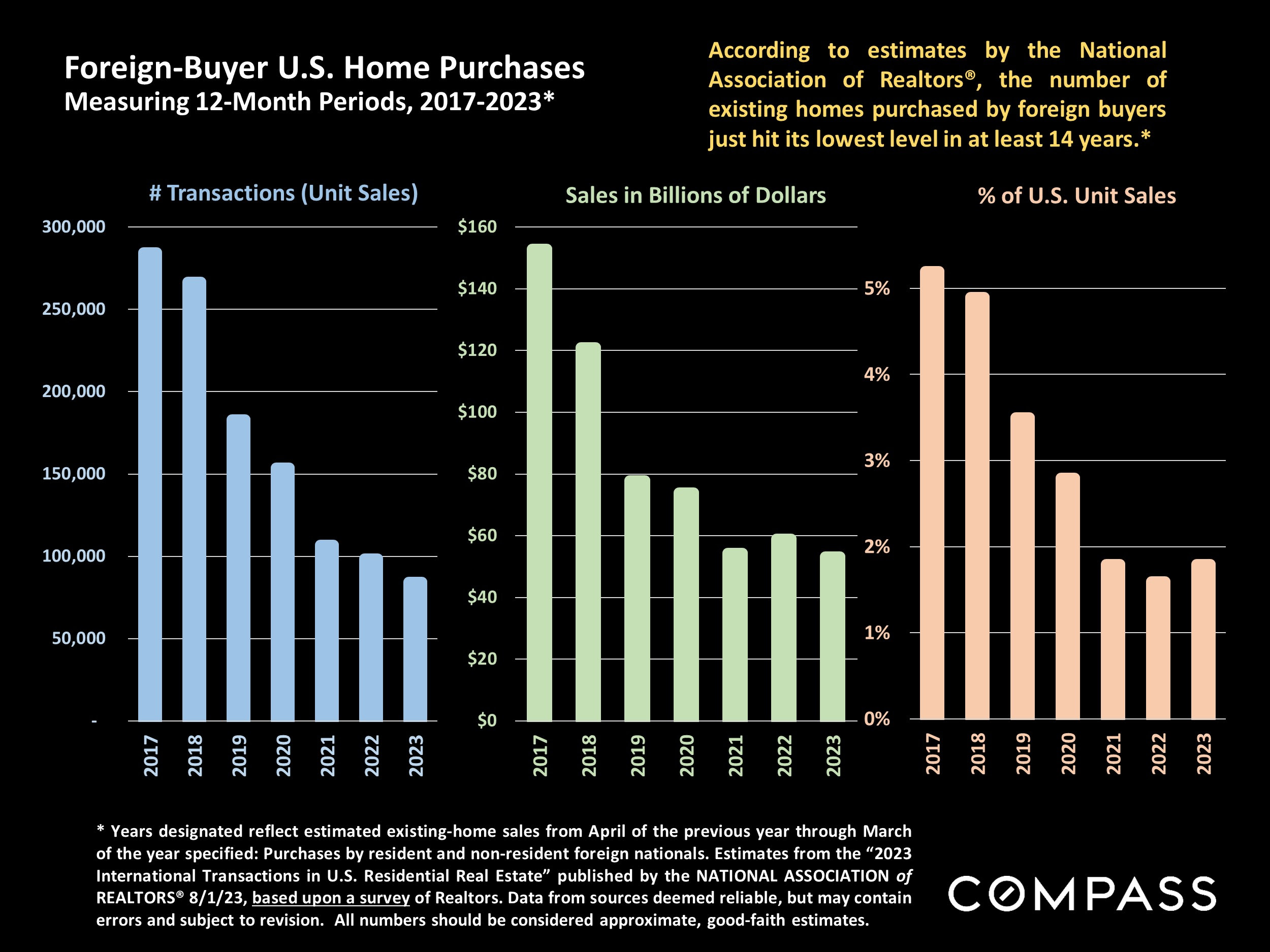

Due to a number of factors, including the pandemic, foreign-buyer purchases of U.S. homes have been dropping for years

(but trends vary by country of origin).

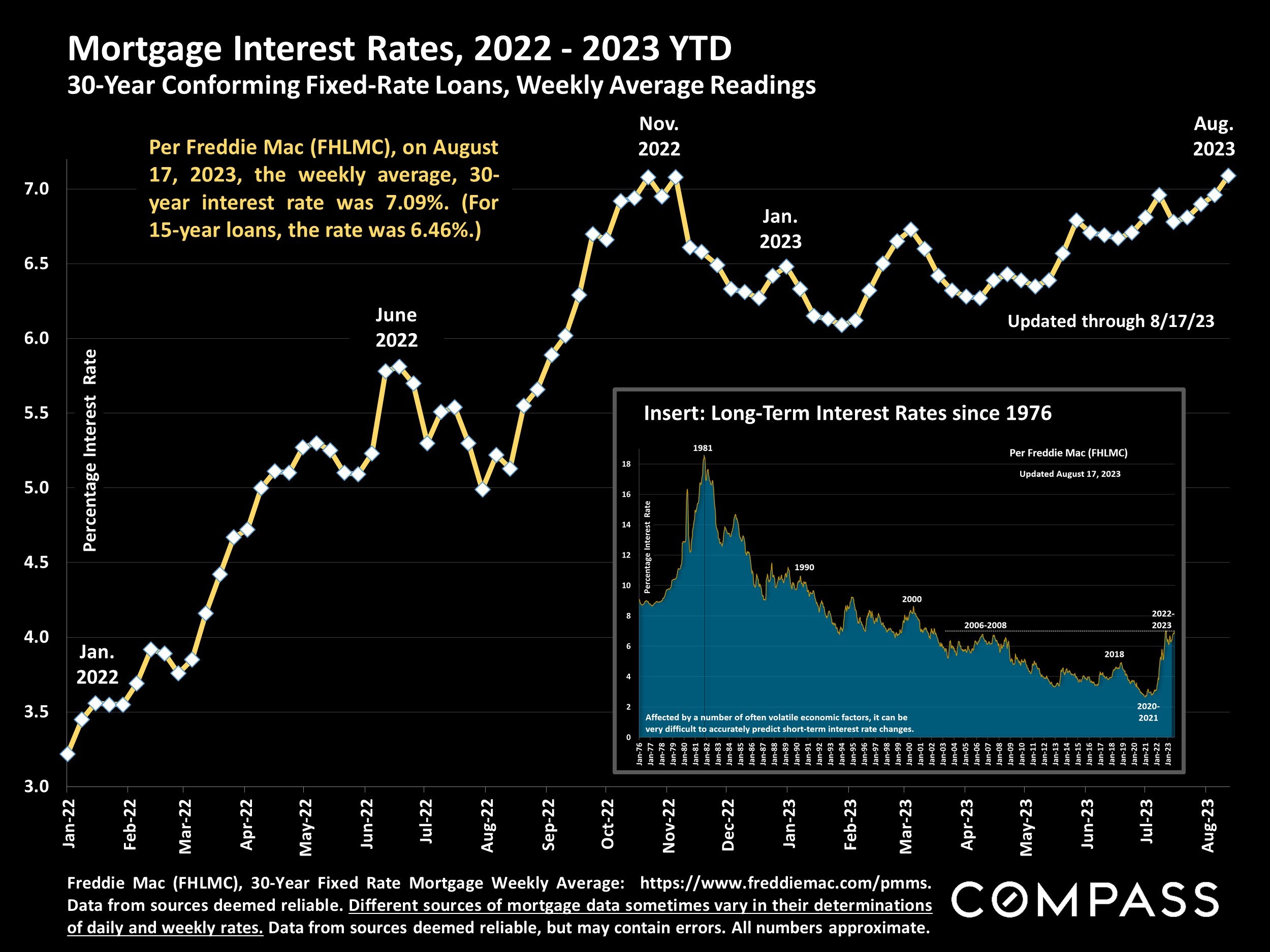

Interest rates since 2022, with an insert illustrating long-term rates since 1976: The weekly, average, 30-year fixed rate recently ticked back up over 7%.

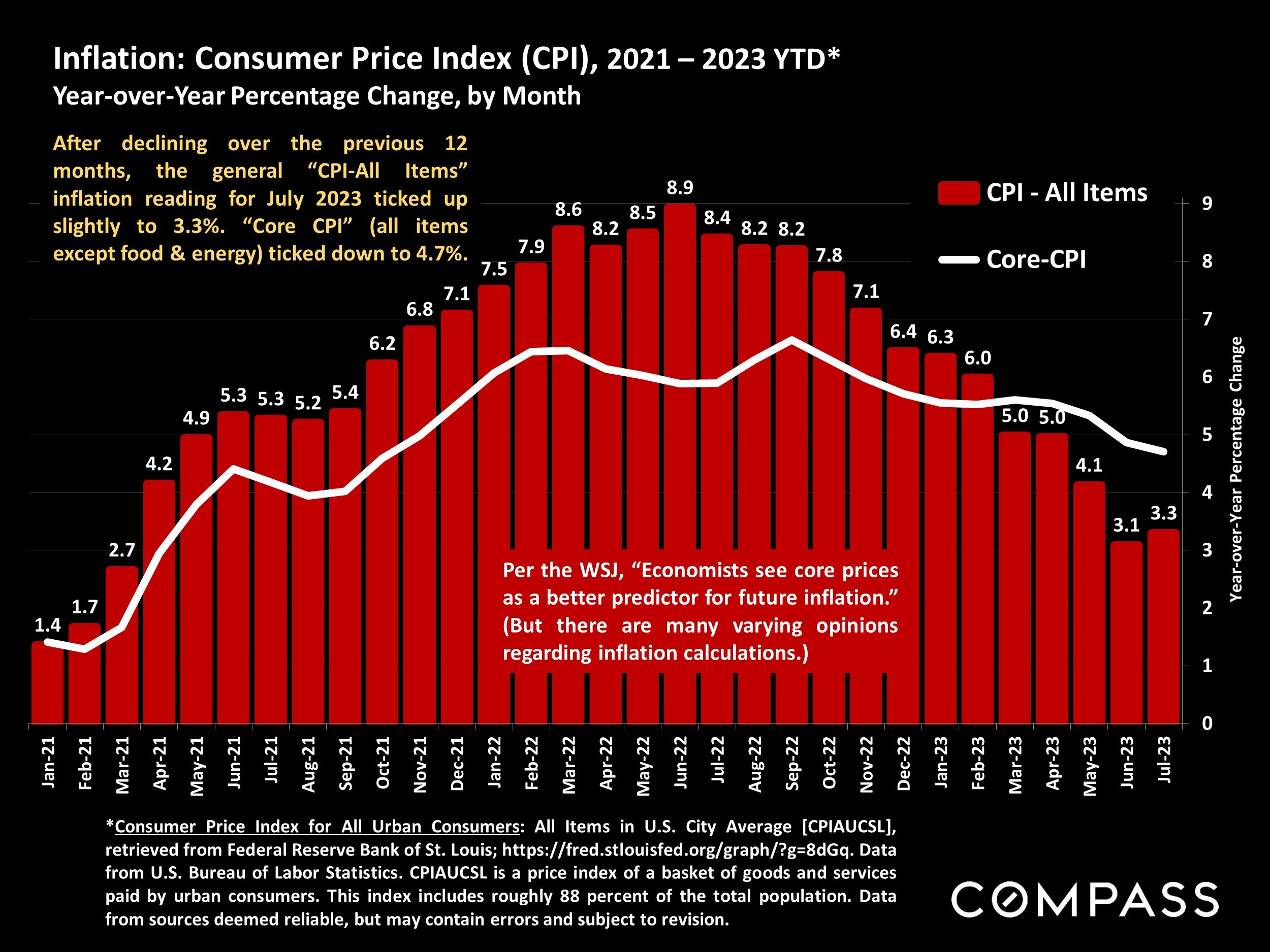

After soaring to a 4-decade high in June 2022, the inflation rate has plunged rapidly since (but remains higher than the Fed would like).

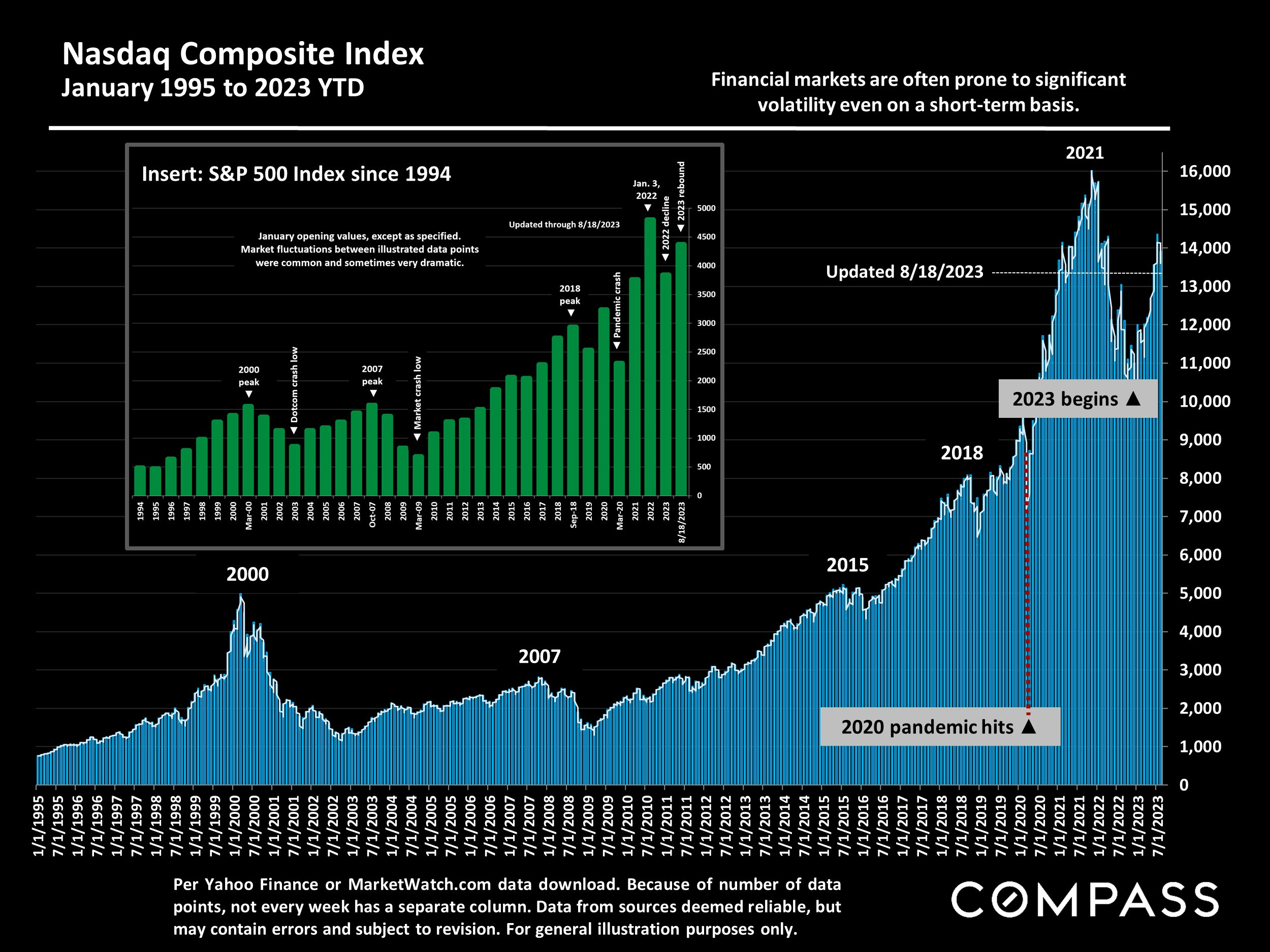

Long-term trends in the Nasdaq and S&P 500: Both have seen large recoveries in 2023, though the first half of August saw declines from July peaks.

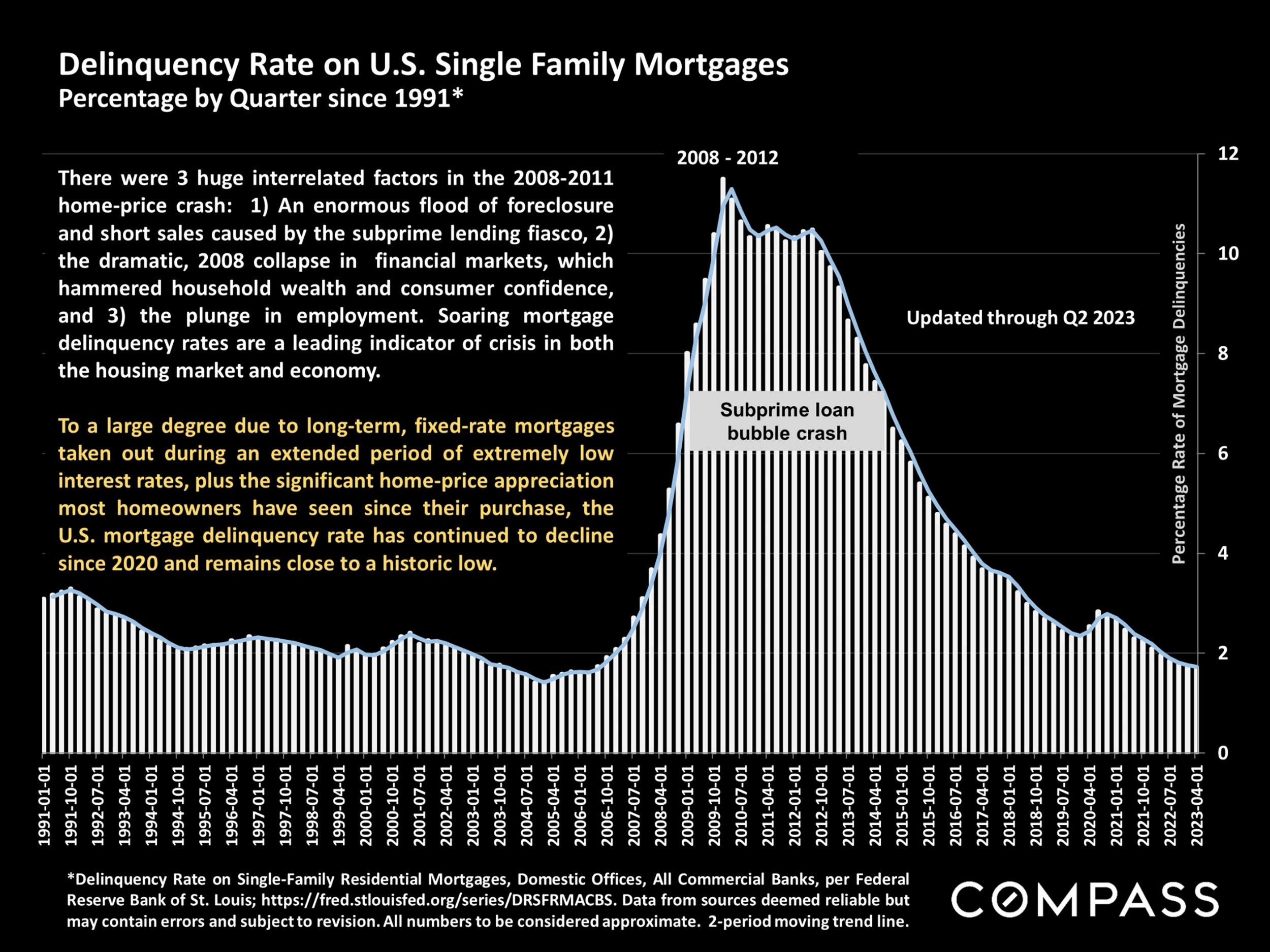

As of Q2 2023, the national mortgage delinquency rate remains close to an all-time low: A positive sign for the economy and the housing market.

According to RealTrends, Compass sells more residential real estate, in dollar-volume sales, than any other brokerage in the nation.

Thanks for reading! Feel free to reach out if you have any questions!

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).